Last month, we concluded our fifth Female Founders in Tech innovation competition, Female Founders in FinTech 2019 presented by Wells Fargo. Before reading ahead, please check out this video with highlights from our most successful competition, yet!

Throughout each phase of the FinTech 2019 competition, we surveyed and/or interviewed over 200 individuals within our community of judges, mentors, industry experts, and applicants and compiled their insights into the below blog spotlighting three of the most relevant topics to financial services in 2020 and beyond…

Artificial Intelligence and Machine Learning

We’re at the start of a new decade and the financial services industry is heading into a transformative era. Most prominent among all areas of transformation is the industry’s commitment to be at the forefront of Artificial Intelligence (AI) and Machine Learning (ML). Startups and incumbents, alike, are making significant investments to harness these technologies for improved efficiencies and new customer experiences. While humans will continue to play an integral part, leveraging AI/ML capabilities to will impact all aspects of the industry.

The Importance of Partnerships

Carefully considering how to effectively approach this new era, and integrate new technologies, will be key to successful transitions. Rather than relying solely on acquisitions or internal development teams, our experts are eyeing partnerships as the primary avenues for ensuring that new technologies, new markets, and new products are successfully surfaced – a strategy that’s inherently mutually beneficial.

Physical Bank Locations

Your local bank branch will look and feel drastically different in 2025 than it did in 2015, but physical bank locations are not going to disappear as they continue to provide high margin services.

Continue below to learn more about these topics and the future of financial services…

Artificial Intelligence Will Optimize Performance And Create New Customer Experiences In Financial Services

AI/ML is one of the biggest talking points for many industries today. According to the Gartner Hype Cycle for Emerging Technologies, AI/ML is just now peaking.

Until now, the vast majority of AI/ML applications have been focused on cost reduction. More recently, we’re seeing the technology applied among a variety of use cases including robo-advising, algorithmic trading, WealthTech, lending, etc. The promise of AI/ML is its ability to augment processes, increase margins, generate better marketing results, streamline operations, and improve the customer experience. What will be interesting to watch for is whether all of these use cases can come together, effectively. A lot of the nitty-gritty work to establish the foundation for AI/ML integration was done 10 years ago. Now, the path forward looks bright for many verticals within financial services but making smart decisions and leveraging the available tools for engineers to build AI/ML solutions without big data centers will be crucial.

One of the primary areas that many of our experts agreed AI/ML technology will impact is wealth management. Throughout the coming decade, there will be an emphasis on financial well-being and WealthTech startups are determined to provide alternatives to traditional products by designing AI/ML software that will advise consumers on investment decisions. Additionally, AI/ML is poised to significantly impact credit analysis and lending. For almost all lending products, the credit reporting process will be influenced by AI/ML algorithms, reducing friction and making the process shorter and (ideally) less risky.

Still, data silos and dataset integrity may continue to challenge effective implementation of AI/ML. Remaining compliant with data collection and retention laws is becoming increasing complicated and the consequences of non-compliance are becoming more severe. To effectively grow AI/ML processes and offerings, the industry must simultaneously innovate and comply with growing public and governmental interest the technology.

Over the next 10 years, these are the areas of financial services that will be most disrupted by AI/ML

Artificial Intelligence Won’t Replace Human Beings. Instead, We Will Learn To Work Together

Many believe that AI/ML means complete and immediate automation, but this is not completely accurate. Importantly, businesses still need human review and calibration of most AI/ML processes. However, over the coming years, the time it takes to review and calibrate these processes will certainly decrease, and eventually only scheduled audits of the algorithms or processes may be needed. Leaders responsible for the results that AI/ML technologies produce will need to play a role in reviewing, calibrating, and auditing in order to avoid unintended results. Managing AI/ML algorithms and processes will undoubtedly become a skillset that the workforce will have to learn, but our experts emphasized that humans will make the ultimate decisions and the technology is not here to simply replace us.

Further to this point, it is important to remain level-headed as media hype and public aversion to disruptive technology is likely to swell (more than it already has) in the near future. We don’t believe this will affect the pace of change, but companies in the financial services industry need to consider measured approaches to integrating AI/ML technologies for their workforces and their customers. For maximum internal and external acceptance of a technology that promises to disrupt as much as AI/ML does, faster, cheaper, and better will need to be accompanied by transparency, upskilling, and education. AI/ML will help employees be more productive and offer worthy products to customers of all sectors of society, but this must be achieved by combining people and the technology together.

Partnerships Will Propel Financial Services Innovation Forward

The model of an all-inclusive financial institution where new ideas bubble-up exclusively from within is squarely in the past. Scalability, velocity, and competition has rendered this strategy as no longer practical. This Is the thesis behind the growing importance of and emphasis on partnerships, and why they provide value to both businesses and customers.

JONATHAN HARTSELL, SENIOR VICE PRESIDENT – HEAD OF DIGITAL BUSINESS DEVELOPMENT & INNOVATION at WELLS FARGO shares:

“At Wells Fargo, we look at exploring big ideas with innovators and how they are solving customer problems. One great example from 2019 is our strategic relationship with TransferMate to power our new cross-border billing product, Global Invoice Connect. This service allows Wells Fargo middle-market customers in the U.S. to invoice their customers abroad and receive global payments from 50 different countries around the world. We leveraged this key relationship and innovative technology to simplify the end-to-end global process for our customers.”

Financial service firms are seeking partnerships across all service areas, but payments represent a particularly significant opportunity. As more of the global economy moves towards cashless payments, we expect to see partnerships as the preferred method for incumbents and startups to establish themselves in this still expanding realm. Relatedly, cross border payments will also see a lot of momentum in terms of partnerships enabling new services and products in more locations.

Partnerships help companies answer customer questions that have gone unaddressed or even unasked. Startups often leverage their nimbleness to tackle those specific or nuanced questions that large institutions have not yet prioritized.

“This year’s Female Founders in FinTech Finalists are a great representative of evolving technologies. AgriLedger is using blockchain for agricultural finance, clinicPesa is building a micro-lending service, Stratyfy is using explainable AI, TomoCredit is providing alternate credit scores, and HomeZada is digitizing the home management space. All these technologies will help customers live better lives. They don’t want to spend time on banking and finance. They want these products to simplify their lives and enable them to meet their goals in their daily lives.”

Partnerships Enable Banks To Reach New Customer Segments Such As The Unbanked And Underbanked

In a recent Forbes article, Angela Strange, General Partner at Andreessen Horowitz stated:

In our interviews, our experts stressed that financial institutions must make the effort to understand why these populations aren’t banking in the first place. One of the best ways to expedite that research is to partner with FinTechs that are solving for the underlying issues affecting the unbanked and underbanked.

FinTechs have spearheaded these markets by offering new credit and financial services specifically targeting people in the gig-economy, immigrants, and the traditionally underserved. Solutions that offer alternative ways to establish and increase credit scores, or provide real-time payments, or offer advanced wages or earned income are examples of ways FinTech startups are establishing footholds in the unbanked and underbanked markets.

By definition, these populations have been outside of the customer base for large banking institutions for a long time, which is why all of our sources agree that establishing meaningful partnerships is a key strategy for engaging these 2-3 billion people.

Physical Bank Locations Are High-Margin Profit Generators For Financial Services Firms

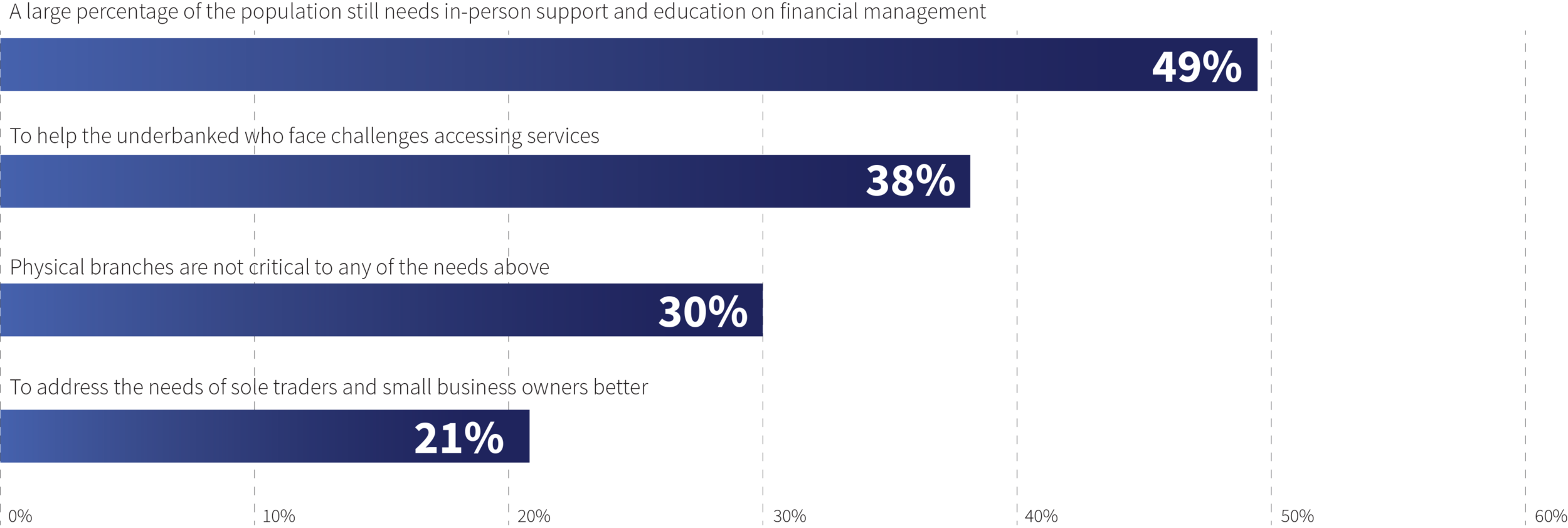

Not only do 48% of online judges who participated in the Female Founders in FinTech 2019 competition believe physical bank branches can help the underbanked gain access banking services, but we’ve heard over and over that physical banks play a big role in high-value transactions. FinTechs should take note of this when approaching banks for partnership opportunities.

As we progress toward an AI/ML integrated landscape featuring large banks partnering with nimble FinTechs, some of our experts advise that physical branches will remain a requirement within specific banking sectors; still, there probably won’t be growth in actual bank locations. Physical locations will be maintained by servicing vital customer segments such as small businesses, high net worth individuals, estate planning, etc. These customers need (and want) in-person interactions with specialists for complex issues. In order to enable physical banks to play this role in high-margin services, while remaining fresh and cost-effective, banks can also look to optimize the integration of video, augmented reality, data collection, and documentation (including remote notary services).

STUART COOK, CHIEF DIGITAL PRODUCT OFFICER at VALLEY BANK noted:

“A lot of the innovation has been focused around retail banking experiences with the rise of challenger banks, and Valley Bank is looking at how we can apply the lessons there to SMBs (small and medium-sized businesses) and mid-market customers.

I do think it is going to be hard for some of the challenger banks to compete against the big retail banks... because of their sheer scale. Most of the services retail banks offer have been increasingly commoditized, so we’ve seen the importance of customer experience in providing the differentiation.

We need to better understand what our customer needs are, and how we build better products that solve these needs. That’s where we see some of the FinTechs excelling, by solving real problems for niche markets and we think banks can benefit through partnerships with FinTechs to leverage their solutions and better meet their customers’ needs in those niches.”

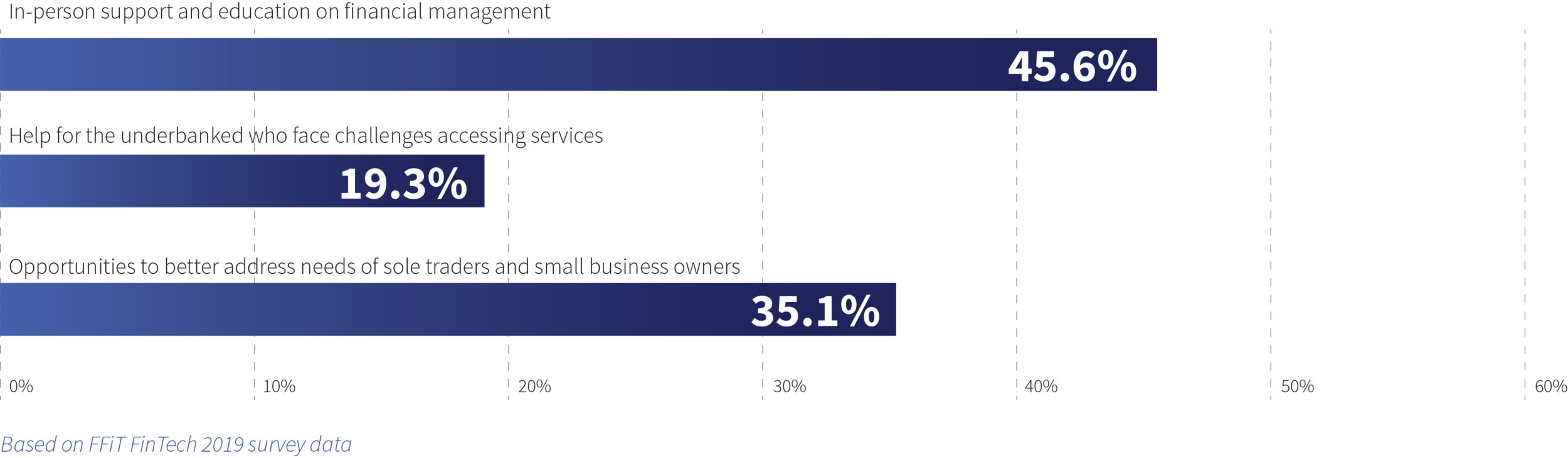

What do physical bank branches offer customers?

“Banks need to figure out how they serve customers better at the actual branch. What we are trying to do at Valley Bank is consolidate our data together to get a more holistic view of the customer. We then want to use this data to provide the right products and services to them at the right time.”

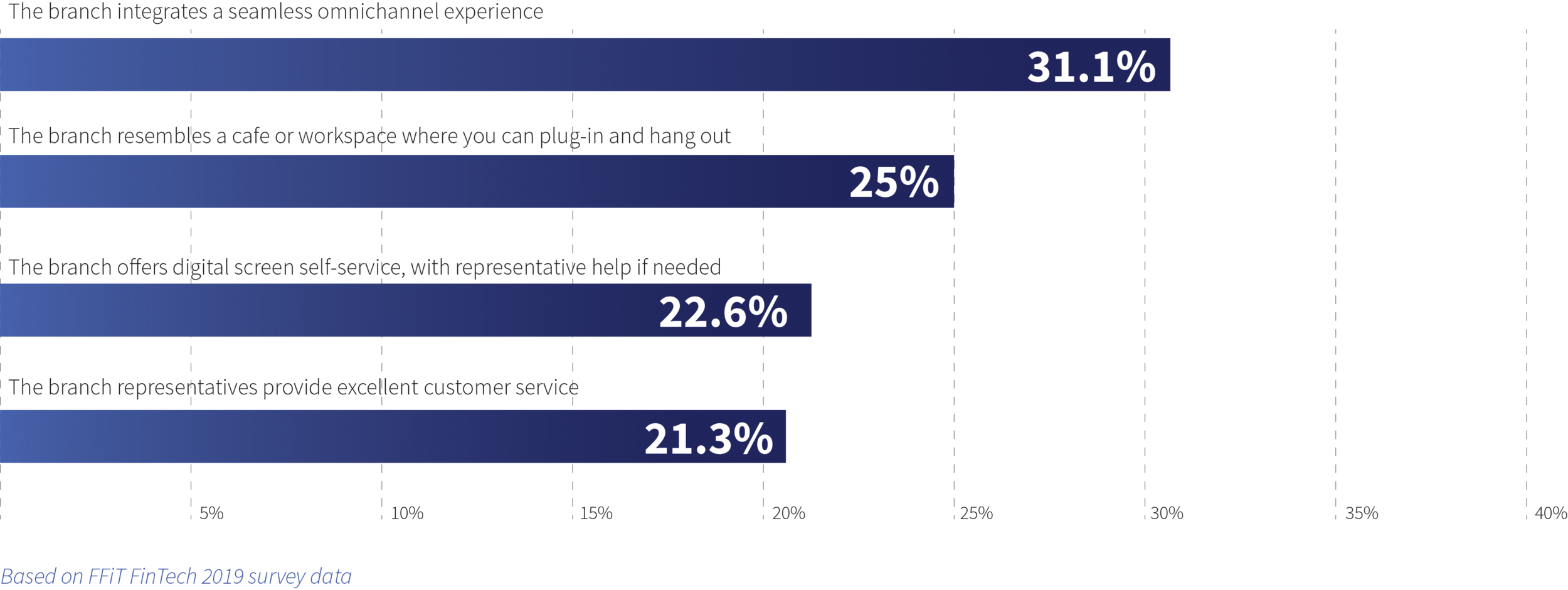

What makes cusumers more likely to visit a physical branch?

Why do consumers still need physical bank branches?

Offering these services is becoming more expensive, so banks will need to leverage new technologies in order to maintain their presence.

“For regional banks, it is very expensive or impractical to have a full suite of specialist services at every physical location. For example, not every bank can have a retirement specialist on location. However, banks can utilize technology such as video conferencing, screen sharing, data and ID capture, and e-signature and remote notary technology to accommodate specialist meetings with clients from any location to provide them with the services they need. Technology will be increasingly used to leverage all the assets physical banks provide to enhance the customer relationship in the future.”

-MATT LYONS, PARTNER, SHEARMAN & STERLING LLP

The Future of Financial Services

We’ve heard many strong opinions about the state of the industry and the future of financial services, but it’s clear that the industry’s brightest minds are concentrated on (1) the enormous role that artificial intelligence and machine learning will play in shaping how businesses of all sizes will be structured and how products will be developed; (2) how establishing partnerships between large financial institutions and FinTech startups will become more vital for both sides as the pace of change increases; and, (3) that the industry should not ignore physical bank locations, but instead look to ways of innovating the high-margin products and services that those locations excel at providing.

We’re excited to see how the industry takes shape in the next decade!

Acknowledgments

Quesnay would like to take this opportunity to thank all of those who contributed to this article:

-Soumya Dev Chakrabarty, Head of Global FinTech Partnerships, Discover Financial Services

-Keith Christoffers, Lead Recipe Owner - AI Assisted Service & Automation, ADP

-Stuart Cook, Chief Digital Product Officer, Valley Bank

-Jonathan Hartsell, Senior Vice President - Head of Digital Business Development & Innovation, Wells Fargo

-Matt Lyons, Partner, Shearman & Sterling LLP

-Emma Maconick, Partner, Shearman & Sterling LLP

-Uma Meyyappan, Senior Vice President, Co-Lead Innovation Research & Development, Wells Fargo

-Sheryl O'Connor, Founder & CEO, WealthConductor LLC

-Donna Parisi, Derivatives Partner - Global Head of Financial Services & FinTech, Shearman & Sterling LLP

-Reena Agrawal Sahni, Partner, Shearman & Sterling LLP

Special thanks to all of the applicants to the Female Founders in FinTech 2019 innovation competition!

For more information about the Female Founders in FinTech 2019 innovation competition, click here.

For more information on how to become a sponsor, partner, or participant of future innovation competitions, or for any general inquiries, please contact us.