To set the stage for this three-part blog series, we asked the community about key pain points in the insurance industry across the data life cycle from data gathering, extraction, analysis, and decision making.

With insurance carriers only investing 3.6% of their revenue in computing technology, they are in danger of being replaced by startups, as well as established tech companies (Amazon, Apple, and Google), who are experts at analyzing customer data (The Economist, 2019). As part of this year's competition, Quesnay surveyed experts in the Female Founders in InsurTech community regarding the data life cycle of incumbent insurance carriers. Of the 90 experts surveyed, 46% of respondents believe carriers are still in the early stages and still in the process of defining specific use cases or business models for data-driven products.

Where is the insurance industry overall in the data life cycle?

Read the first part of this blog series to understand key pain points for the industry around the use of data.

DATA SILOS PREVENT CARRIERS FROM HAVING A HOLISTIC VIEW OF THEIR CUSTOMERS

EXPERTS HIGHLIGHTED CARRIERS' INABILITY TO EASILY SHARE AND ACCESS DATA ACROSS THEIR ORGANIZATIONS AS THE BIGGEST PAIN POINT IN THE INDUSTRY.

The Insurance industry faces foundational challenges as it attempts to aggregate a wealth of customer data.

There are three general functions organizations perform with data as part of the data life cycle: gathering data, storing data, and delivering data. One of the biggest challenges in this lifecycle is reconciling data from multiple sources from across an organization.

One reason for this is that legacy systems have led to data silos within the carriers. Different departments aren’t communicating with each other, so carriers don’t have a complete picture of their customers.

Our experts reinforce this view: “Most carriers have massive amounts of data dispersed across different departments and across different systems within the organization. One of the most prominent pain points is accessing and organizing all of that data. Even if they can access it, making sense of it and extracting the most value out of it can be a challenge, especially for smaller organizations that may not be able to invest in data scientists. Further, adding third party information to their existing data can also be a challenge. I often hear questions like: which sources are the best/most accurate, or how do I know the data is correct.”

- STEPHEN GOLDSTEIN, VP CLIENT EXPERIENCE LEAD, RGAX

There are examples outside the industry on how to create a more integrated view of customer data.

“The biggest pain point for any industry is data silos. While often apparent at legacy companies that are decades old, even early stage organizations are susceptible. Business divisions create lots of data and often don't share it across the organization. This makes it hard to get one data set that is consistent, validated and visible enterprise-wide. Companies have tried tackling this problem in a number of different ways. When I was at Williams Sonoma, replatforming was implemented to identify the customer across product lines. At CSAA Insurance Group, we have a similar opportunity. We know that an insurance customer has a homeowners or auto policy with us, but we don't always know if that customer also has a AAA membership, which provides access to other services including roadside assistance and travel. Connecting these data points is a very powerful way to better understand and serve our customers.”

- BETI CUNG, HEAD OF INNOVATION LABS, CSAA INSURANCE GROUP

OTHER PAIN POINTS ACROSS THE DATA LIFE CYCLE

INSURANCE DATA NEEDS TO BECOME MORE DIGITAL, IS PARTICULARLY VULNERABLE TO CYBER ATTACKS AND IS IMPACTED BY REGULATION AND COMPLIANCE.

Carriers need to shift from paper to digital.

“Up until the last 10-15 years, paper has been the predominant way we have completed applications and managed policyholder servicing. Even today, some of the information we collect from policyholders is on paper and requires a wet signature. To create the most value from their data, carriers must look at in-force and new data sources. This means that (for many), reams and reams of historical data need to be digitized before realizing the full potential of their data analytics strategy.”

- STEPHEN GOLDSTEIN, VP CLIENT EXPERIENCE LEAD, RGAX

Carriers are concerned about protecting their data from cyber attacks

“Anything related to personal information, PII data and similar, must be secure. This pain point exists when capturing data and transmitting it. It is critical to ensure that the data is properly encrypted.”

- MITCH OCAMPO, CHAIR OF RGAX DISTRIBUTED LEDGER TEAM, RGAX

Using data to personalize products for different customers is challenging due to a complex regulatory landscape.

“It is not easy to personalize insurance products for a variety of reasons. First, the industry is highly regulated so the ability to customize pricing is very limited. Every time you have a pricing change you need to have a state by state approval. Personalization of coverage is on the radar for every big insurance carrier. Usage based insurance is allowing this to an extent, but if we talk about ad hoc personalization for different risks we are still a few years out. There are regulatory and data issues associated with this that the insurance industry still needs to solve.”

- JERRY GUPTA, SVP DIGITAL CATALYST, SWISS RE

THE GOOD NEWS...

The good news is the insurance industry has become more agile across the data life cycle.

“Where the industry is making headway is in accelerating the data life cycle. Historically, the data life cycle was time consuming. The industry is now looking at a more iterative process. Companies are learning from data on-the-go and making decisions based on the value of the data. The process is quicker than it was in the past.”

- BETH MAERZ, SVP, CUSTOMER, STRATEGY AND INNOVATION, TRAVELERS

HOW INSURTECHS CAN HELP INSURANCE CARRIERS

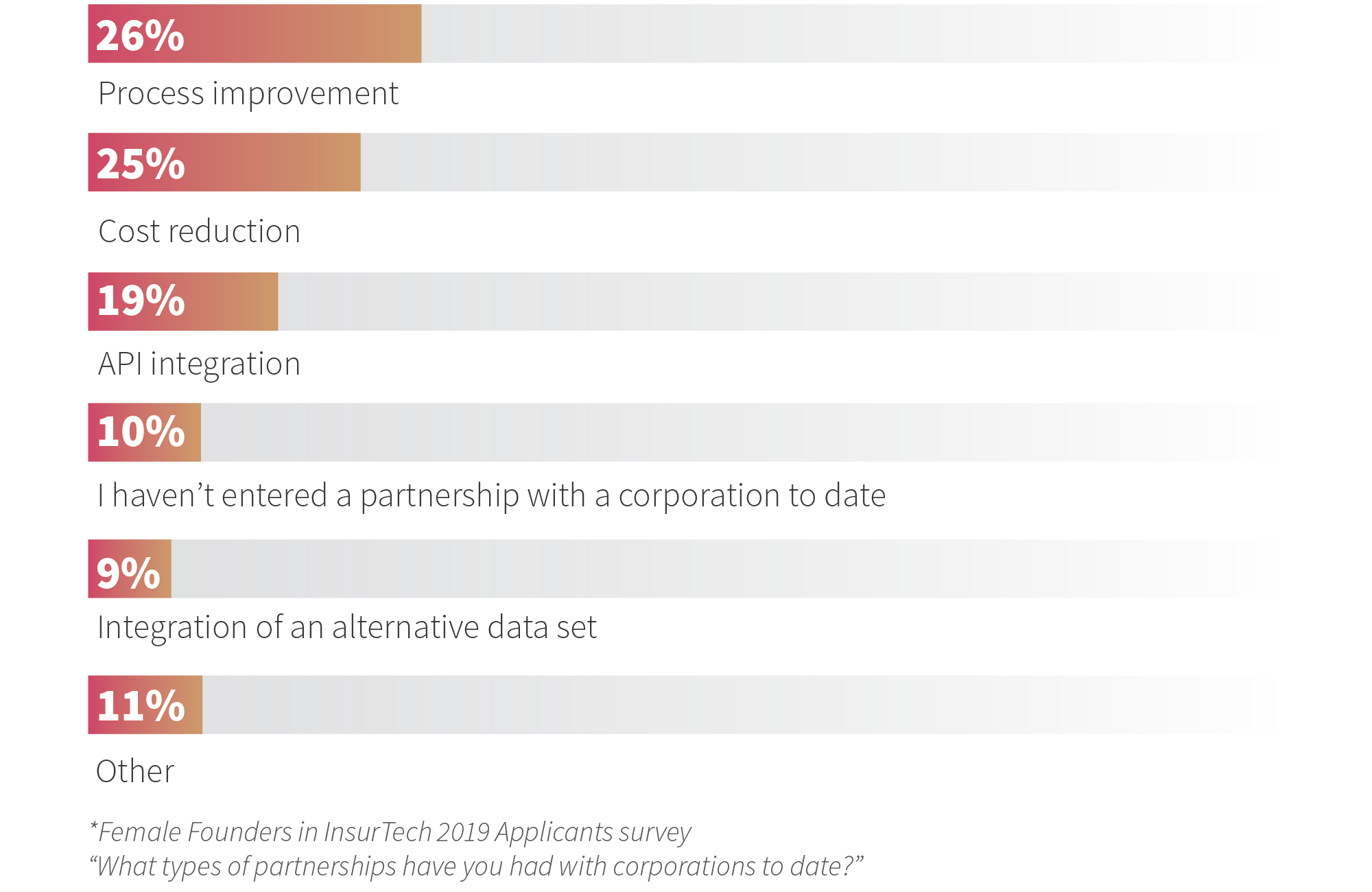

One way carriers are shortening the data life cycle is by partnering with InsurTechs. As part of this year’s competition, Quesnay surveyed Female Founder’s in InsurTech 2019 Applicants and saw that 26% of them are implementing process improvement solutions with insurance carriers.

Additionally, 44% of Female Founders in InsurTech 2019 Applicants surveyed believe they can help insurance carriers solve data challenges by optimizing the data collection process.

Thank you for reading the first part of this three-part blog series. In the next post we will discuss New Data, New Use Cases. If you are interested in learning more about Quesnay's services please contact us.