Carriers have enormous potential to use existing and new data sets to drive better outcomes from an operational and customer acquisition and retention standpoint. One of the largest emerging data sets for the industry is Internet of Things (IoT) data. However, carriers will need to overcome challenges like data ownership, regulation, and security to properly use this data. Hear from experts on this subject in our second blog post.

IoT, THE NEW DATA SET TO WATCH FOR IN INSURANCE

The Insurance industry will be the largest consumer of IoT data but carriers will face challenges in acquiring it.

Experts we interviewed see the industry around IoT data as a massive opportunity. It includes wearables, drones, telematics, etc. Wearable devices and sensors perform constant readings and this allows carriers to collect new sources of data. Insurance carriers will eventually use this data to shift their business model to a preventative business model. IoT devices will provide access to real-time data that can lower costs for carriers and customers over the long-term.

Carriers will need to consider a few factors when accessing IoT data: (1) the governance of the data given that they are not generating the data, and (2) the current inconsistency in approach by data providers when charging for data use.

IMAGERY AS A NEW DATA SET

Carriers can also use imagery to capture data they need more efficiently.

“Imagery is another massive opportunity. The questions we previously asked people about the physical world can now be captured in a picture. In some scenarios, we no longer manually collect data. If we properly process an image, we can extract the data from there. This is happening across the insurance industry today.”

- BETH MAERZ, SVP, CUSTOMER, STRATEGY AND INNOVATION, TRAVELERS

NEW DATA SETS AND WAYS TO ANALYZE DATA WILL IMPACT EVERY PHASE OF THE INSURANCE LIFE CYCLE

Carriers need to evolve their definition of what data is and how to gain insights from new sources.

“The insurance industry is looking at new sources of insights that historically haven't been thought of as data. At Travelers we see this happening with our customers call transcripts, which we are now leveraging to make better business decisions. As we start pushing deeper into understanding what data is, and understanding what interactions, transactions and engagement models are creating data, we are re-thinking what the life cycle looks like.”

- BETH MAERZ, SVP, CUSTOMER, STRATEGY AND INNOVATION, TRAVELERS

“While I don't think the motherlode of data sets exists, it really depends on how clever your team is at marrying data sets and digging for insights. There is no shortage of interesting data, but there must be a way to translate its relevance to the business. We study weather conditions, aerial imagery and topology to improve our understanding of risks related to climate. These data sets inform decisions, and improve our ability to underwrite insurance policies.”

- BETI CUNG, HEAD OF INNOVATION LABS, CSAA INSURANCE GROUP

HOW INSURTECHS CAN HELP INSURANCE CARRIERS

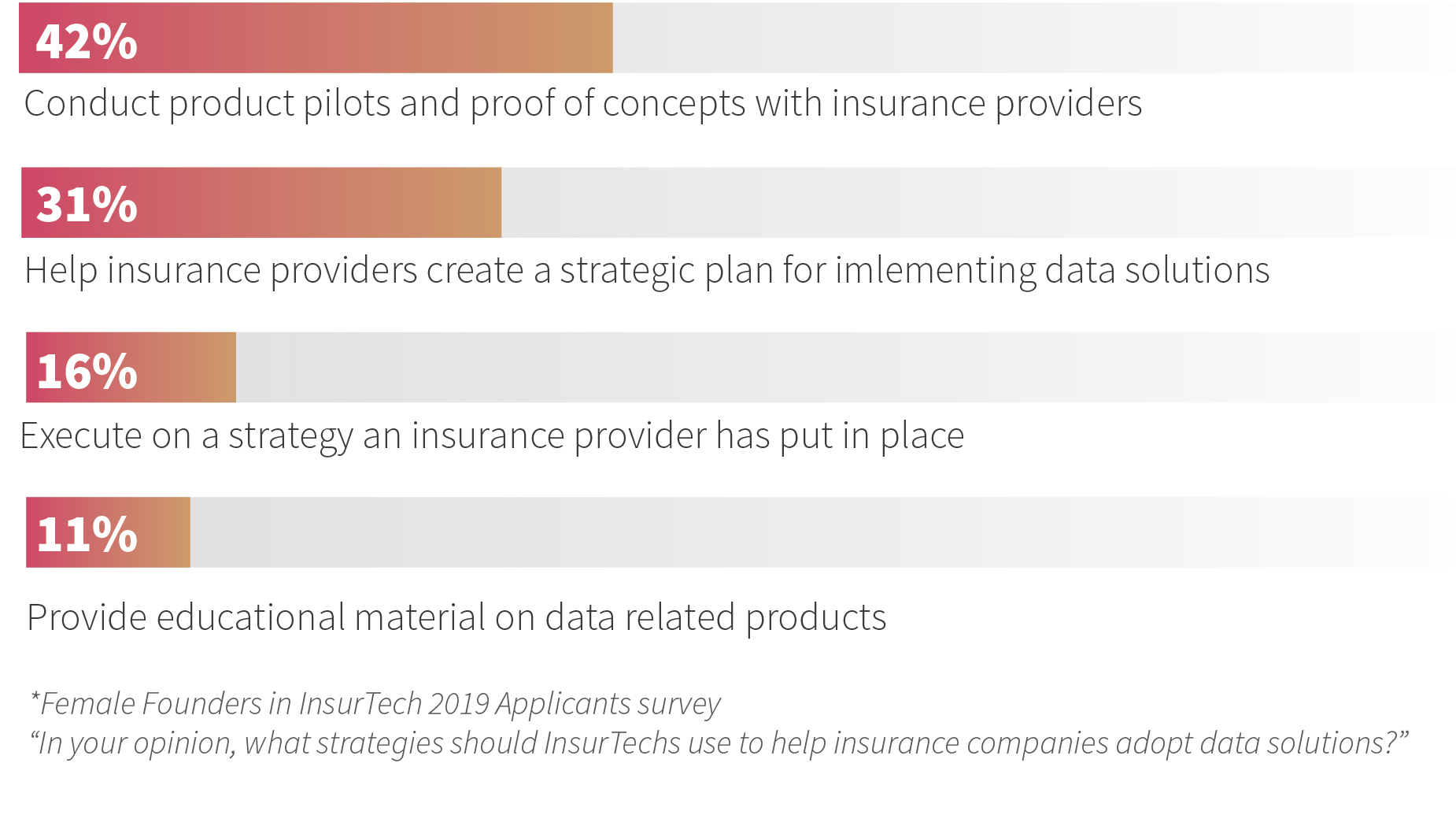

We surveyed Female Founders in InsurTech 2019 Applicants and found that almost 75% of them believe they can help carriers adopt data solutions through pilot programs and strategic implementation plans.

A promising use case for data is managing risks from weather related events.

“I think parametric insurance really represents an opportunity for insurance carriers. These products rely on big data and digital technology and can provide new mechanisms to insure against risk posed by climate change and the resulting natural catastrophes. For example, Swiss Re has a parametric product for hurricane insurance in Asia. Any time wind speeds reach a pre-specified threshold, the claim is automatically triggered and a payout happens without any action required by the insured.”

- JERRY GUPTA, SVP DIGITAL CATALYST, SWISS RE

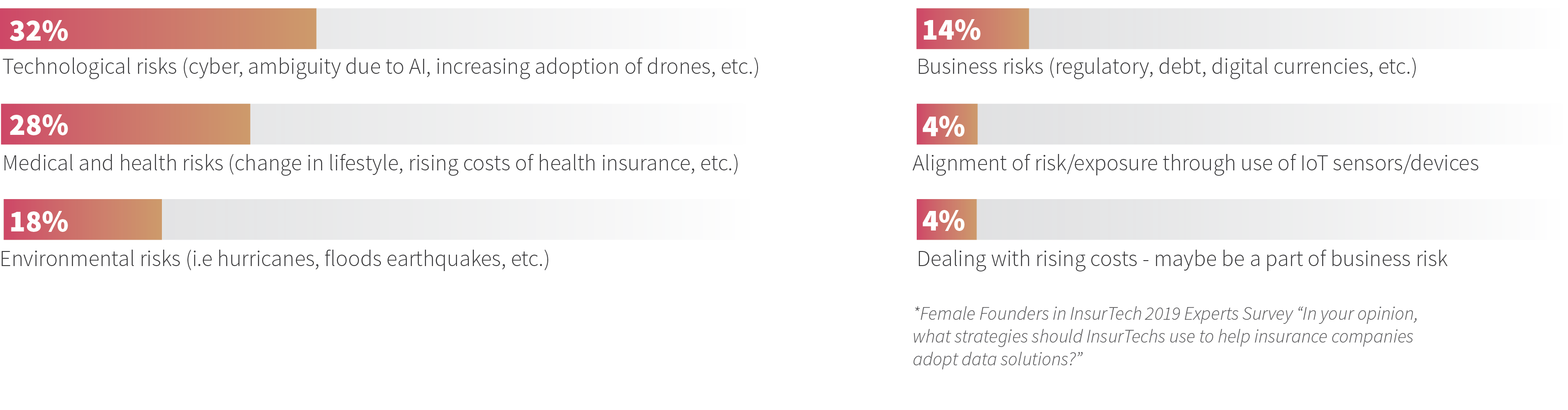

OVER 75% OF RESPONDENTS IDENTIFIED TECHNOLOGICAL, MEDICAL AND HEALTH, AND ENVIRONMENTAL RISKS AS TOP AREAS IN NEED OF INNOVATION IN THE NEXT 2-3 YEARS

In addition to customer insights, carriers can use data to optimize the underwriting process.

“In terms of operational efficiencies, claims and underwriting have the most to gain from improved data sets. While on the customer experience side, marketing, fulfillment and post policy issuance will all benefit. When it comes to underwriting for life insurance, the two biggest pain points for customers are: (1) the number of questions they need to answer and (2) having to provide doctor's reports and fluids (blood/urine). Life insurance carriers are looking to use data to simplify the underwriting process and to overcome these pain points. RGA and RGAX help carriers by using credit history, prescription information, attending physician summaries and other data to simplify this process.”

- STEPHEN GOLDSTEIN, VP CLIENT EXPERIENCE LEAD, RGAX

In our last and final blog post we will look at The Next Big Opportunities in Insurance Data .

If you are interested in learning more about Quesnay's services please contact us.